ARTICLE AD BOX

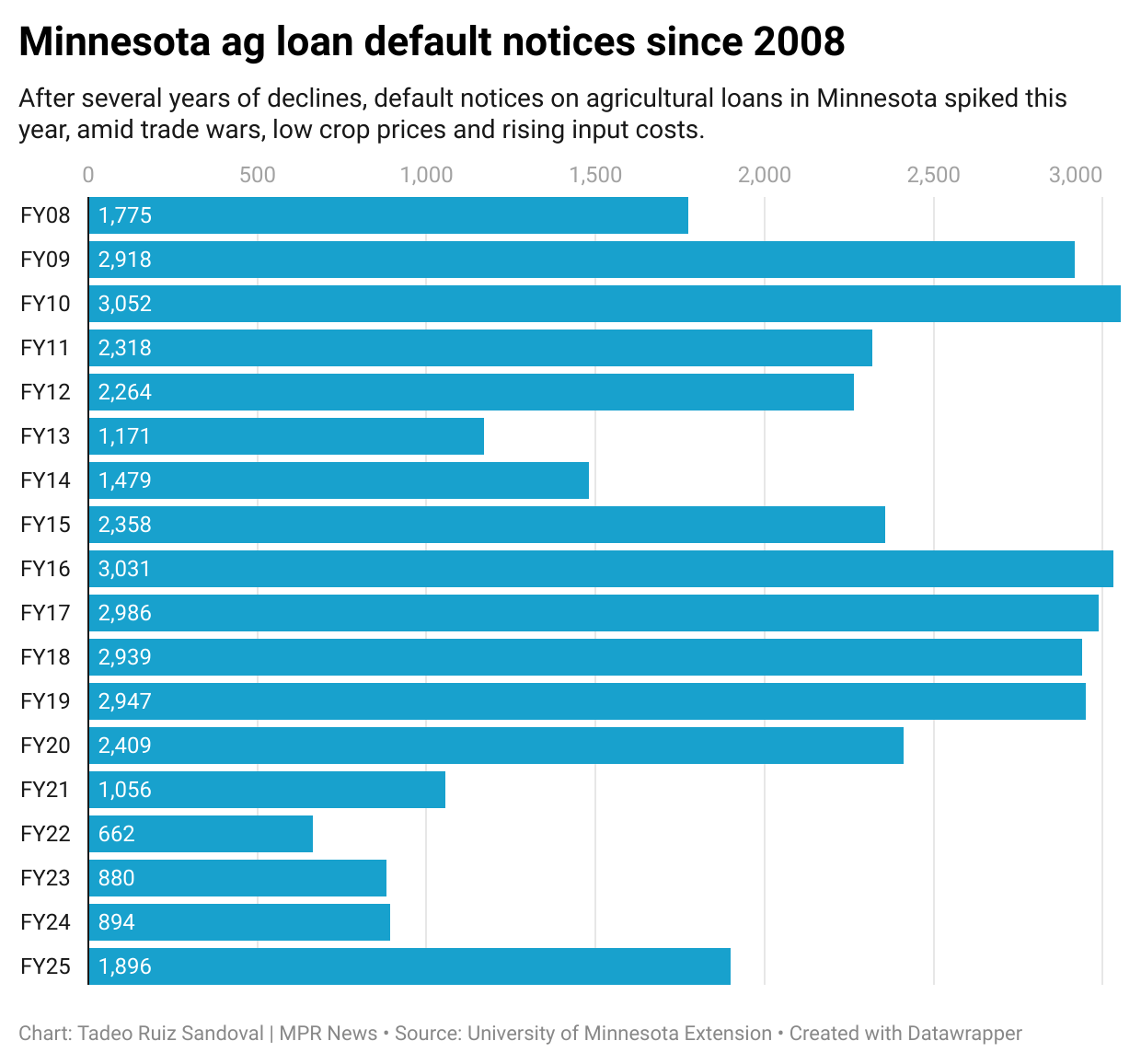

Farmers’ finances are in peril. In the midst of trade wars and low commodity prices, loan defaults are rising among Minnesota producers. In fact, defaults have doubled in fiscal year 2025 compared to the previous year, according to University of Minnesota Extension data.

Rising defaults mean more farmers asking mediators for help negotiating loan terms with lenders.

“Mediators are neutral facilitators. We're kind of glorified referees,” said Mary Preisler, program director of U of M Extension’s Farmer-Lender Mediation program.

By state law, mediation services must be offered to farmers who have defaulted on a loan of over $15,000. And Preisler’s office sees the default notices come through.

The team works in tandem with Farm Advocates, a Minnesota Department of Agriculture program that offers business and crisis support for farmers.

“There may be health problems within the family, the cow herd or whatever,” said Bruce Lubitz, who helps mediate between farmers and lenders at Farm Advocates.

“You wind up not only dealing with the lender, you’ve got to deal with all these other problems, too, in order to make things work,” he said.

The farmer-lender relationship

Lubitz can relate well to what farmers are going through, especially when it comes to needing to restructure loans with their bankers. Forty years ago, during the farm crisis of the 1980s, Lubitz farmed alfalfa, corn and oats in Perham, Minn. At the time, his finances were in bad shape.

“My first wife had cancer,” Lubitz said. “We were struggling with paying the bills and trying to farm.”

His wife was carrying his youngest son at the time, as well. When it seemed there was no way out, a woman working with the Minnesota Department of Agriculture came to help him refinance his debt. It was the start of what would become the Farm Advocates team Lubitz works for today.

“I thought, ‘Well, I managed to get the help, why not try and pass it on?’” Lubitz said.

Minnesota farmers’ loan defaults have increased in the midst of low commodity prices and high monthly costs, hurting farm incomes. That’s according to the latest ag credit survey from the Federal Reserve Bank of Minneapolis.

Speaking outside the Fed’s blackout period, the report’s author, Joe Mahon, said last month that those conditions were making lenders uneasy.

“They're concerned about certain agricultural borrowers' ability to continue paying and servicing the debt that they already have,” Mahon said.

The situation can be stressful for both farmers and lenders alike in mediations. During one session years ago, he recalled a farmer nearly lunging at a lender after the banker called him names.

“My farmer got up, and he was reaching across to grab that lender,” Lubitz said. “And I said, ‘Bob, settle down, sit down.’ And he sat down. Never said another word then, and that lender — to this day — I think he believes I'm God, because he really likes me for saving his butt.”

The two parties managed to figure something out. And according to Lubitz, that farmer still operates to this day, thanks, in part, to that mediation.

Mediators are strained

Farmers’ need for mediation help is coming simultaneously with the federal government shutdown, which is affecting many programs funded by the U.S. Department of Agriculture.

Preisler said it's getting harder to give farmers the help they need because her own team with U of M Extension is cash-strapped due to the federal government shutdown.

“Seventy percent of our budget [is] from USDA,” Preisler said. “Now, with a government shutdown, that has definitely affected our whole program.”

Preisler’s team consists of eight part-time mediators. Even with limited time and fewer resources, she’s said her team is ready to handle what they expect to be a busy 2026.

“All of us are veterans,” Preisler said. “My team might be older, but they are also wiser, and so they know the mediation process.”

Meanwhile, USDA announced on Wednesday that over 2,000 Farm Service Agency offices would reopen to allow farmers to access $3 billion in aid. Two workers will be stationed at each office to help producers apply for loans, crop insurance and disaster aid, among other services.

Preisler said while FSA offices reopening is good news, she’s still concerned about the backlog of loan requests they’d have to take on.

FSA provides services like loan consolidation to struggling farmers and is a key resource for helping farmers refinance their loans.

“That's a huge lender, both in guaranteed loans, direct financing and in government payments,” Preisler said.

Other options for help

Online tools such as FINPACK, a University of Minnesota finance software, are also readily available to help farmers’ financial planning.

And there are other loan options available through programs like the Rural Finance Authority, the state’s ag lender. Matt McDevitt is the program’s finance manager. He said that as farmers wrap up harvest, they’ll start re-assessing their financial standing in the coming months.

“They’re going to make decisions on what they do,” McDevitt said. “Then, those decisions might lend to whether they want to go get a loan or not, to help solve some of their issues.”

He added that many farmers are trying to guess how commodity prices might change, which could affect their financial planning.

For example, things might get better if the United States makes a trade deal with China, as it has decided not to buy any American soybeans for the upcoming market year.

“Time will tell if, for whatever reason, some kind of tariff deal gets struck and China agrees to buy a whole pile of soybeans here in the next three weeks,” McDevitt said. “That could stave off a lot of issues as well.”

Preparing for more defaults

For his part, Lubitz, the farmer-turned-mediator, is gearing up for what he said might be an increase in default notices in the coming months once farmers finish their harvests.

"Once the crops are in and the bank lenders know what is available and whatever else, then we are expecting a real increase in phone calls for services," Lubitz said.

He said that tends to happen at the end of the year, around the holidays, which means Christmastime is often ruined for many farmers.

This story was updated to reflect the reopening of over 2,000 Farm Service Agency offices across the nation. FSA programs were partially shuttered at the time of original publication and have since resumed operations in a limited capacity.

Editor's note (Oct. 23, 2025): This story was updated to reflect the reopening of over 2,000 Farm Service Agency offices across the nation. FSA programs were partially shuttered at the time of original publication and have since resumed operations in a limited capacity.

English (US) ·

English (US) ·