ARTICLE AD BOX

AJ

The Parallel Market dropped again intarday in Iraq.

The Parallel Market dropped again intarday in Iraq.

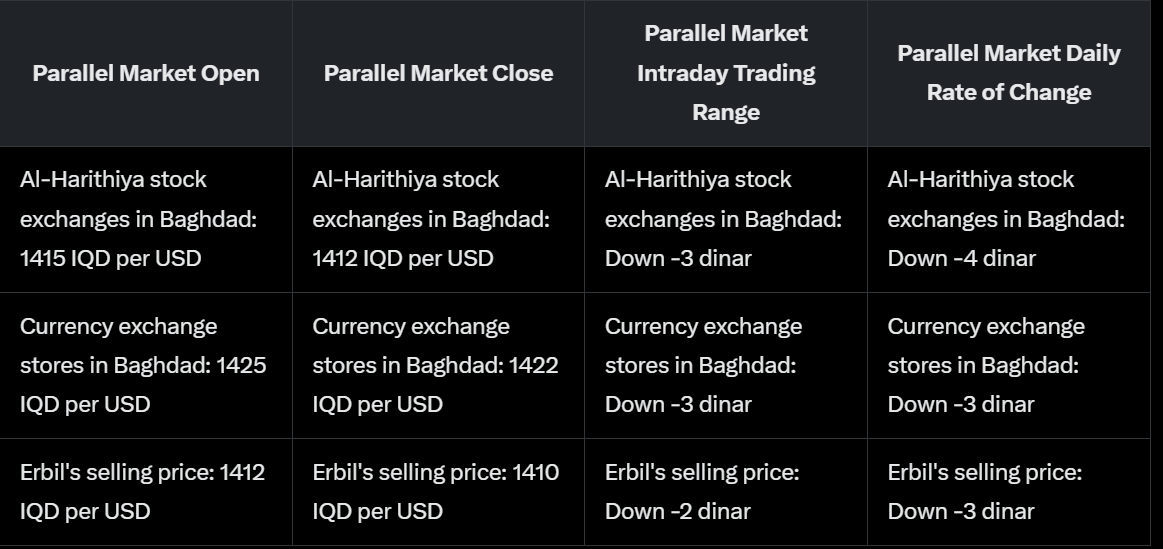

I created a table for you showing the Parallel Market in Iraq.

The 1st and 2nd columns display the opening and closing prices.

The 3rd column shows the intraday price change, and the 4th column reflects the daily rate of change from the previous day's closing price.

Example

Intraday Al-Harithiya stock exchanges in Baghdad: Down -3 dinar

Daily Al-Harithiya stock exchanges in Baghdad: Down -4 dinar See attached Table

The recent prices confirm that the Iraqi Dinar is gaining strength against the US Dollar across multiple regions in Iraq.

Intraday Al-Harithiya stock exchanges in Baghdad: Down -3 dinar

Daily Al-Harithiya stock exchanges in Baghdad: Down -4 dinar See attached Table

The recent prices confirm that the Iraqi Dinar is gaining strength against the US Dollar across multiple regions in Iraq.

I also noticed a narrowing gap between buying and selling rates, which indicates stable market conditions and growing confidence in the Dinar.

This suggests that reduced speculation and a tighter supply of Dinars are driving this movement. Traders appear more confident in the local currency, particularly as regional tensions with Iran are easing.

The recent ceasefire between Iran and Israel may have indirectly bolstered this optimism by reducing pressure on regional markets. This likely contributed to yesterday’s significant drop of 21 Dinars in the parallel market...a rare occurrence.

Additionally, the Central Bank of Iraq (CBI) continues to manage liquidity effectively. Its regular interventions in the dollar auction system help stabilize exchange rates and reduce volatility.

The CBI has announced plans to unify the parallel market rate across Iraq with the official rate of 1,320 IQD per USD in the second half of 2025. This alignment is a critical step 1st for a currency revaluation.

The CBI is collaborating closely with exchange shops to monitor currency flows and ensure fair pricing. It has stated that the parallel market rate will gradually align with the official rate to avoid shocking the markets.

As the Dinar strengthens, importers benefit from more favorable rates when purchasing goods abroad. This leads to lower retail prices and reduced inflationary pressure for Iraqi citizens.

The data also shows that demand for the US Dollar remains relatively stable, but the increase in Dinar strength suggests a growing preference for holding the local currency.

As the Dinar gains against the Dollar in key markets like Baghdad and Erbil, I believe the next few weeks will reveal a trend of the pace of declining rates to gauge how long this may take.

By the way, tomorrow is a holiday in Iraq. You can put questions in comments AJ

AJ

AJ

AJ2:25 PM · Jun 25, 2025

English (US) ·

English (US) ·