ARTICLE AD BOX

In the past five years, only four universities have spun off 20 or more startups annually. The University of Minnesota ranks among the top four during that time frame.

The U’s Technology Commercialization Office (TechCom for short) focuses on the business prospects of ideas generated by researchers there.

TechCom has been involved with 285 startups since 2006, and nearly half of that growth has been since 2020. Its initiatives range from protecting intellectual property to licensing the right to use an invention to backing startup companies.

“We're actually generating money and recurring revenue that we can then put into new startups and new research,” said Rick Huebsch, Associate Vice President for Research and Innovation at TechCom. “And we have an ecosystem within the university that we can really help those startups.”

TechCom’s work helps to generate some revenue for the school, but it also helps to burnish the U’s reputation as relevant to the state’s economy and business ecosystem at a time when the Trump Administration has been trying to gut federal funding for research at American universities.

“The university invested a little bit more in the office, brought in some people from the outside, and then really supported the entrepreneurial ecosystem, sort of this entrepreneurial feeling within the faculty,” said Huebsch.

Of course, no one knows which startups will thrive and which will falter. Most of the companies formed out of the University of Minnesota’s business pipeline are acquired by a larger company.

The startups the U has been involved in have gone on to raise $3.4 billion in outside capital and they’ve created 1,500 high-tech jobs. Nearly 70% stay in Minnesota.

Numbers like these support the idea that developing a dynamic and supportive environment for entrepreneurs, venture capital investors and employees hikes the odds for continuing long-term success.

“Having a healthy ecosystem isn't having one or two people around. It's having a set of people so that when you need the talent, they're here. When you need to have people that understand intellectual property, they're here. When you're trying to build things like AI, you have people here,” said Huebsch. “It's kind of that great circle of innovation.”

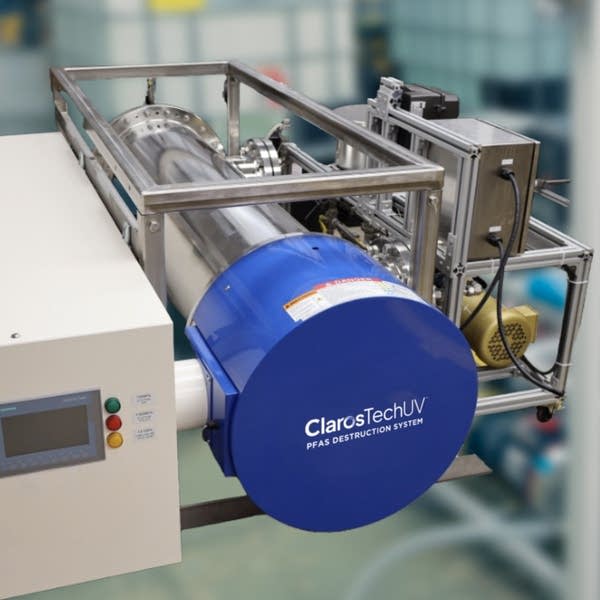

The circle of innovation includes Claros Technologies. Headquartered in Minneapolis, its proprietary technology aims at destroying PFAS waste or "forever chemicals.”

PFAS are critical to manufacturing numerous products and processes, including chipmaking, heart stents and many pharmaceuticals. Yet PFAS have also been linked to a growing list of health problems — hence the growing business of figuring out how best to destroy PFAS waste.

“The kernel… came from the University of Minnesota, and that is where my co-founder, John Brockgreitens, is from,” said Michelle Bellanca, co-founder and CEO of Claros.

Early on the company licensed several patents from the university that involved the capture of PFAS (which would be eliminated later on). “We negotiated the license to spin that out from the OTC, the group that Rick runs,” Bellanca said. “And then that was the beginning of Claros.”

The company has since made several pivots to focus its technological advances on directly destroying PFAS in industrial waste rather than trying to capture it first, said Bellanca.

There are several major reasons why universities like the U are devoting more resources to commercializing Ivory Tower research.

Three reasons in particular stand out, observed Brian Rosenberg, former head of Macalester College and currently visiting professor at the Harvard Graduate School of Education.

First, higher education in recent years has embraced the teaching and the culture of entrepreneurship on campus.

“I think entrepreneurship has just become kind of the latest thing in higher education,” Rosenberg said. “In part, because of the glorification of Silicon Valley and the fact that so much money, so much stock market valuation, is in these tech companies, you're seeing entrepreneurship being central at institutions.”

Second, university reputations have taken a nosedive with the public, largely thanks to the brutal combination of the high cost of college and student loans, Rosenberg said. Not only is the worth of a college sheepskin questioned these days, so is the value of university-based research.

“And so one of the ways that universities can demonstrate that they are, in fact, contributing tangibly to the state's economy, to the state's jobs, is by encouraging and identifying these spin offs,” said Rosenberg.

The third factor, Rosenberg said, is that the traditional model for researchers to relying on federal funding was suspect even before Donald Trump returned to the White House. Since then, the Trump Administration has confirmed the suspicion that the federal government is an unreliable partner.

“It's very hard to go back to a world in which you treat it as certain,” said Rosenberg. “I think you're going to see universities looking for other sources of revenue, and I think you're going to see more of them trying to monetize some of these startups.”

That’s certainly the case at the U.

TechCom spun off a record 26 startups this past year. The ambition is to ramp up to, say, 30-50 startups a year. A pace like that would mark a significant boost to Minnesota’s entrepreneurial ecosystem.

English (US) ·

English (US) ·